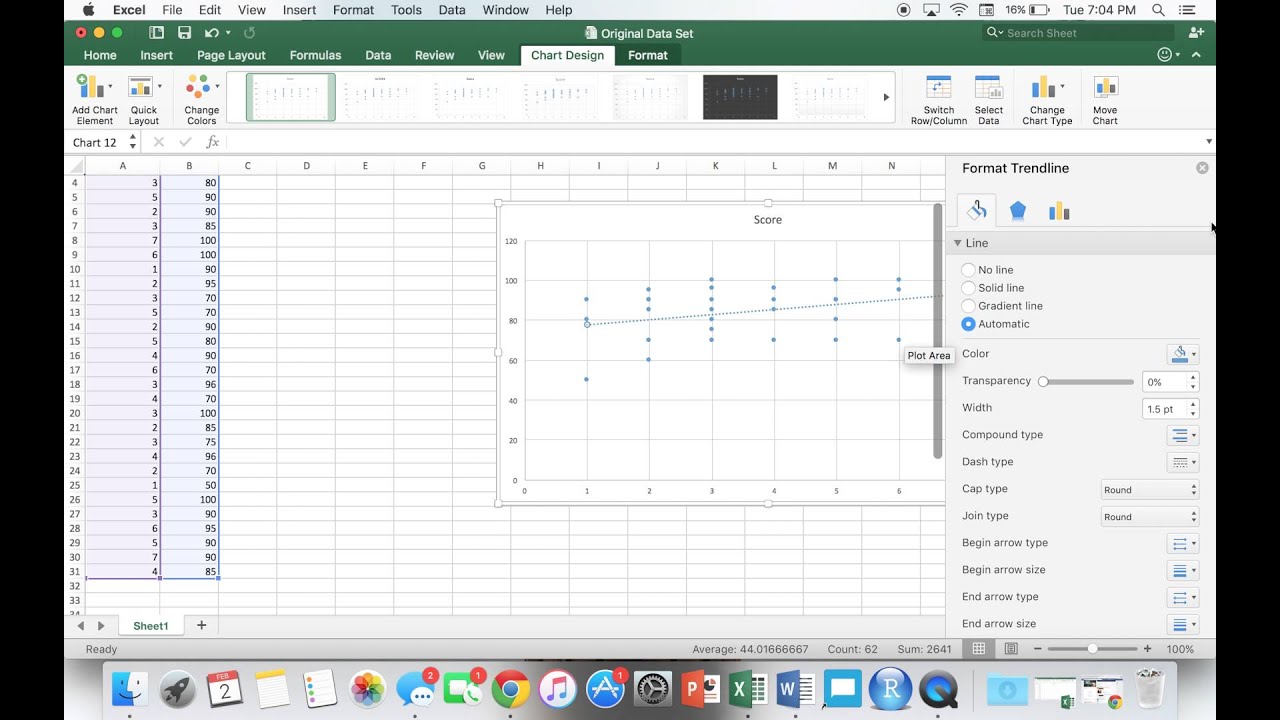

Would love any direction on how to get to the finish line. I'd love to be able to decipher what tusharm is describing in this post to the point where I could replicate this myself. I've tried exponential smoothing, moving average, and even the forecast function, but all of them don't seem to produce the result that seems to make as much sense as the power curve. I need to forecast the rest of the values through 48 months. Note: Excel transforms the power function approximation into the linear model fitting: the power. where: a and b are the parameters of the function found by the least squares method (also named function coefficients or constants ). I have the one column representing decreasing transactions each month that look like this: The power trendline is a curved line described by the function: y a xb. The power curve trendline seems to have the closest R-square value (again still trying to learn what that is) to 1 and well, it just looks closer than any of the other trendlines. Anyway, I am doing a lifetime value analysis and my data set shows a series of transactions starting off strong and steadily declining over time. I am cursed with desperately trying to catch up from not taking math or statistics in college. Our teams of industry-focused specialists are able to identify and engage with key. We provide a high quality, cost effective service, delivering better results for our customers. OK, I am trying to solve the exact same problem that chastst is, except I am dumber, well, a lot less smart. Armstrong Craven is a global talent mapping and pipelining partner for scarce and senior positions.

0 kommentar(er)

0 kommentar(er)